Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

This lecture is from Finance and Accounting. Key important points are: Parity Conditions in International Finance, Currency Forecasting, Purchasing Power Parity, Theory of Purchasing, Arbitrage and Law of One Price, Relative Purchasing Power Parity, Confounding Effects

Typology: Slides

1 / 18

This page cannot be seen from the preview

Don't miss anything!

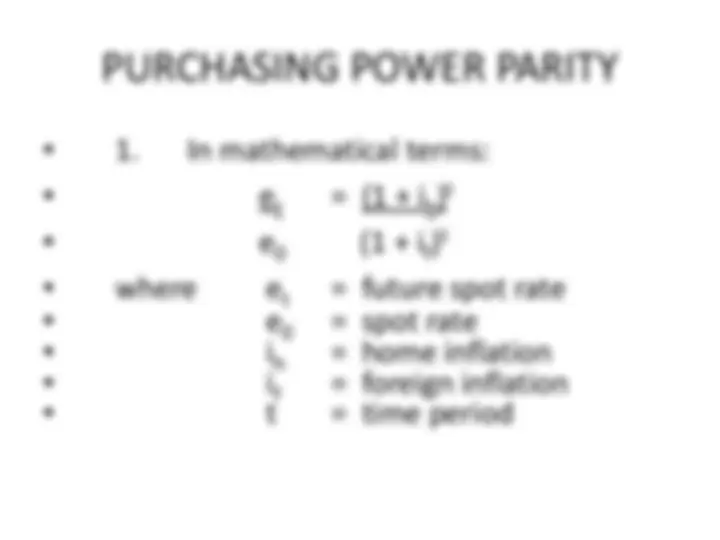

PURCHASING POWER PARITY

Rationale behind PPP Theory

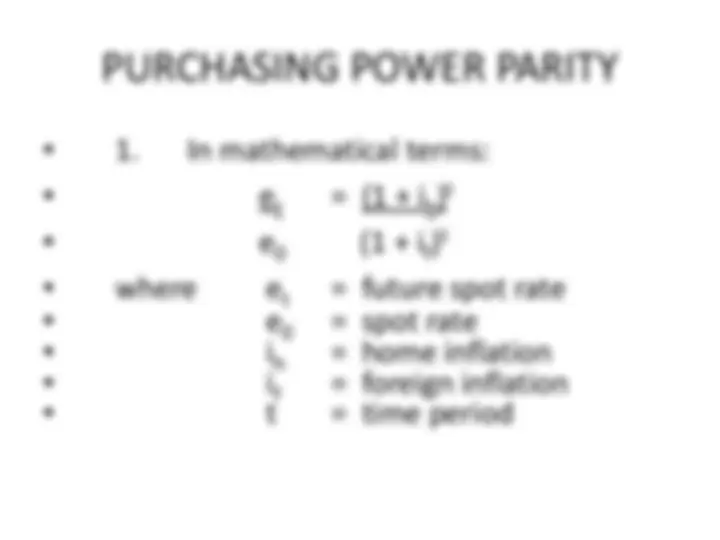

PURCHASING POWER PARITY

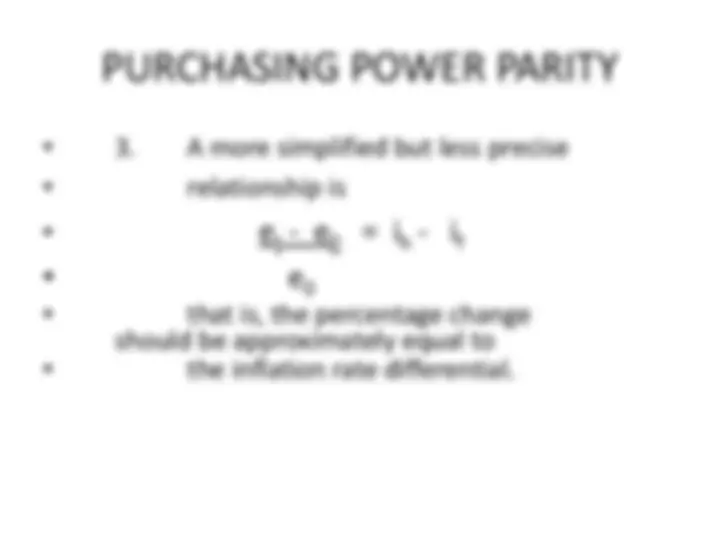

PURCHASING POWER PARITY

PURCHASING POWER PARITY

Why PPP Does Not Occur

THE FISHER EFFECT

PART IV. THE INTERNATIONAL

FISHER EFFECT

THE INTERNATIONAL FISHER

EFFECT

THE INTERNATIONAL FISHER

EFFECT